by Matthias Sterzer, the German Realtor with Kaufman Realty & Auction, helping people buy and sell houses in Tuscarawas and Coshocton County.

“Matthias, what’s the market like right now in Eastern Ohio?”

Answer: Ohio home prices rose +4.84% year‑over‑year in Q3 2025 while the U.S. overall was +2.2%, and Coshocton’s local stats show low inventory, fast days to contract, and strong list‑to‑sold performance. If you’re a seller in Tuscarawas or Coshocton County, this is a favorable window price with precision and presents beautifully.

Hi, I’m Matthias Sterzer—The German Realtor® with Kaufman Realty

I serve Coshocton, Tuscarawas, and surrounding Eastern Ohio communities, and I translate market data into clear pricing strategies. Here’s what Q3 2025 means for your sale.

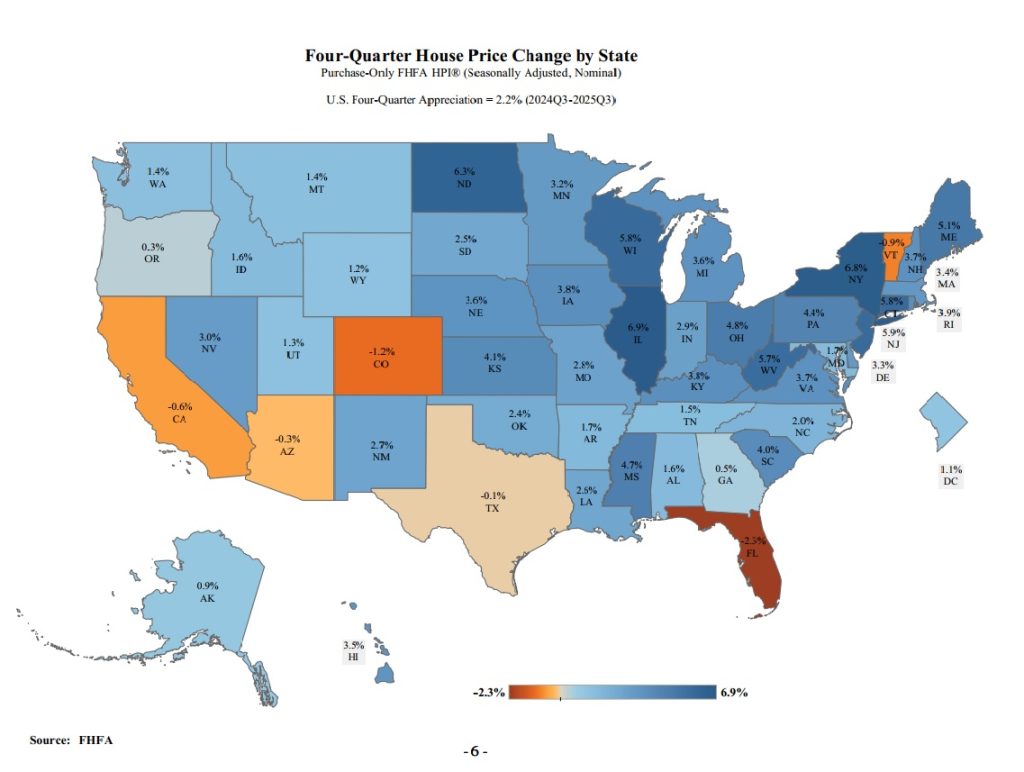

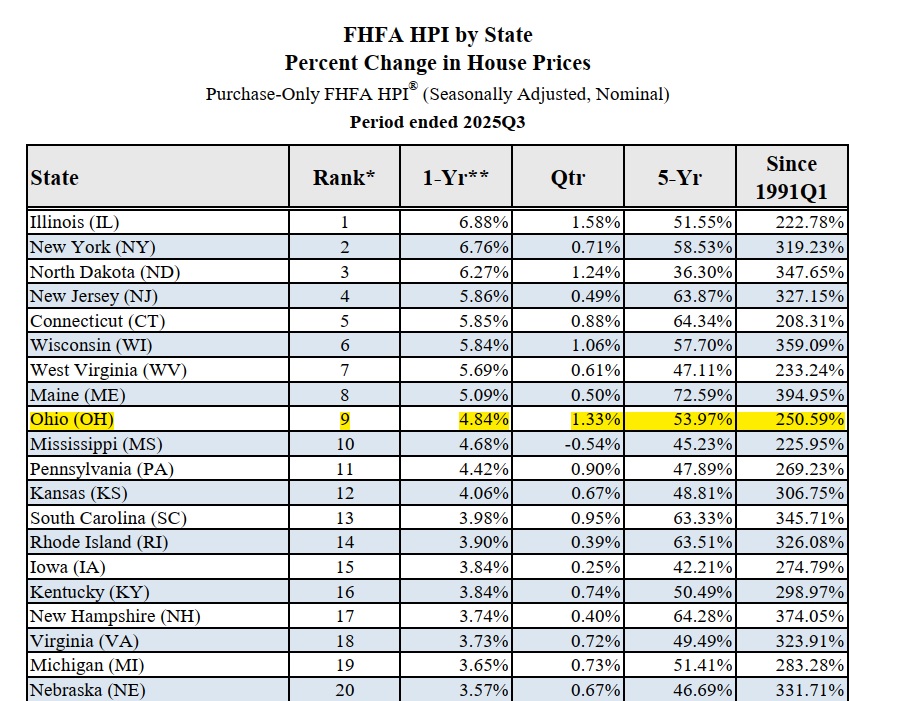

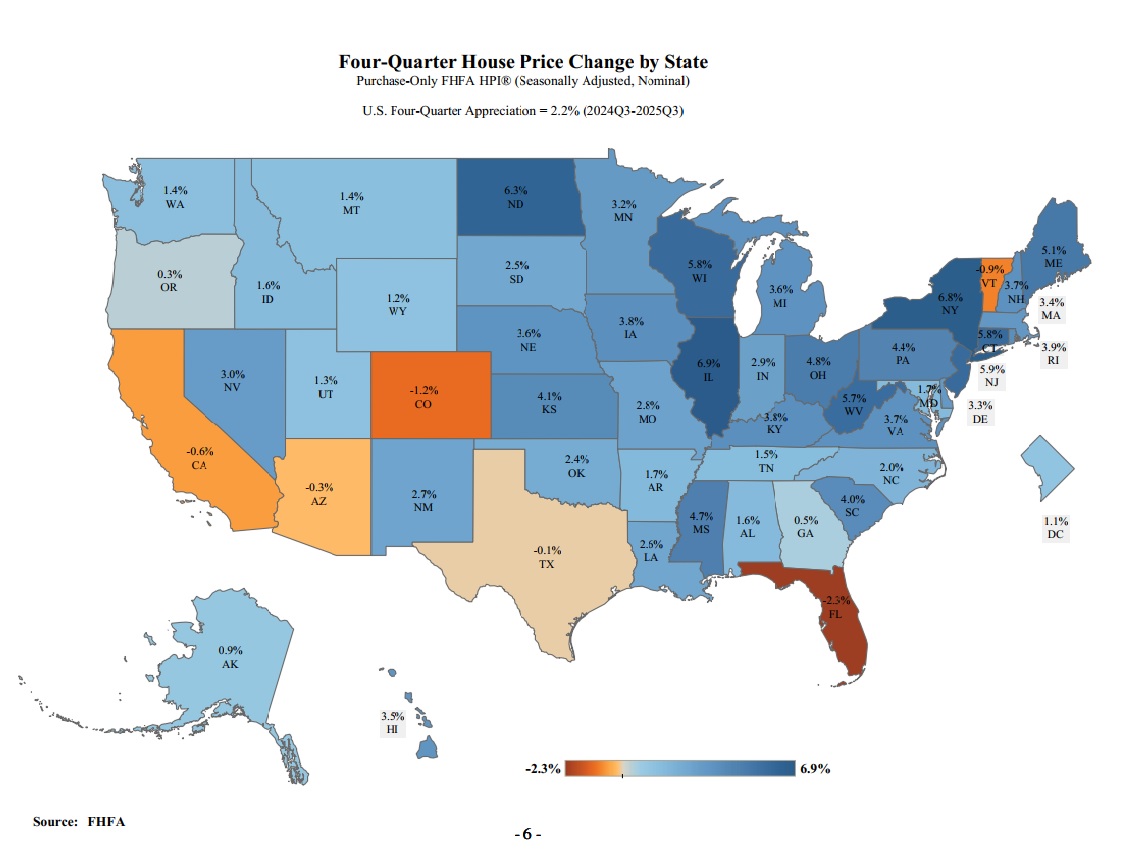

1) Macro backdrop: Ohio outperformed the national average

- Ohio: +4.84% annual appreciation in Q3 2025; quarterly change +1.33%—a healthy, steady trend.

- U.S.: +2.2% annual appreciation and +0.2% quarter‑over‑quarter; September’s monthly index was flat vs. August, signaling moderation—not a reset.

- Regional context: The East North Central division (includes Ohio) posted +5.4% over the latest 12 months—among the stronger regions.

What this means for you: Pricing in Ohio is buoyed by steady demand. For sellers, you don’t need to “chase the top,” but you should price to the market and lean into presentation and timing.

2) Micro reality check: Coshocton’s numbers favor well‑prepared sellers

From your RPR Market Activity (Nov 2025):

- Months of Inventory: 1.81 (seller‑leaning conditions).

- Median Days in RPR: 15—homes that show well and are priced right move quickly.

- Sold‑to‑List Price: 105.3%—indicates competitive bidding or strong pricing discipline.

- Median Sold Price: $155,000 (Nov), with a median list price at $220,000—a split that reminds us to analyze property‑specific comps (condition, updates, neighborhood).

Seller takeaway: With low supply and fast contract times, presentation, pricing, and pre‑launch marketing can amplify results—especially for well‑updated homes in Coshocton, Dennison, New Philadelphia, Dover, West Lafayette, Uhrichsville and nearby.

3) Q&A: How should I price my home in Tuscarawas & Coshocton?

Q: Should I list high and “test” the market?

A: In a 1.81‑month inventory environment, strategic pricing beats testing. Over‑pricing risks stale days and price cuts; right‑pricing creates early momentum and multiple offers.

Q: Do macro stats matter if buyers are local?

A: Yes. Ohio’s +4.84% YoY trend and regional strength support buyer confidence, but micro stats—comps, DOM, list‑to‑sold ratios—drive your result. We’ll blend FHFA macro with RPR/MLS comps for a precise story.

Q: What upgrades deliver ROI right now?

A: Based on local buyer feedback and speed‑to‑contract data:

- Kitchen/bath refreshes, clean finishes, modern lighting.

- Comfort systems (roof/HVAC/windows) documented with receipts.

- Accessibility where relevant (zero‑step entries, grab bars).

These features support faster offers in markets posting 15 median days and 105.3% sold‑to‑list.

4) Pricing & prep checklist

- Run hyper‑local comps (last 90–180 days within 0.5–2 miles; similar size/condition).

- Use a macro context line: “Ohio +4.84% YoY; East North Central strong at +5.4%.”

- Pro photography + floor plan + video tour to increase digital engagement.

- Launch strategy: list mid‑week, open house weekend one, review offers Monday.

- Negotiation plan: price to attract traffic, then negotiate terms (as‑is, occupancy, appraisal gap) from strength.

What’s next?

If you’re thinking of selling in Tuscarawas or Coshocton, let’s price it right the first time. I’ll pair the data (FHFA’s Q3 2025 trends) with fresh local comps and a launch plan tailored to your home.

Call/Text: 740‑610‑8725 • The German Realtor® | Kaufman Realty

Let’s schedule a 20‑minute pricing consult and map your best path to sold.

Leave a Reply